Connecticut Tax Liens Credit Fix & Flip Loans We Buy Houses

Home Buying For Smart People Webinar Real Estate Investment Club of Western CT

Connecticut Tax Liens

Benefits of Buying Real Estate Tax Liens

Real Estate Tax Liens: A Smart Investment Opportunity

Diversify your portfolio with real estate tax liens – a low-risk investment with substantial rewards. Here’s why:

- Simplicity: Buying tax liens is straightforward, requiring only a basic understanding of the process.

- Value Proposition: Purchase liens at a fraction of their face value for significant returns on modest investments.

- Security: Your investment is secured by a lien on the property, ensuring repayment in case of tax non-payment.

Investing in real estate tax liens allows you to reap real estate benefits without property management stress.

Benefits of Tax Liens:

- Bargain Prices: Acquire properties inexpensively and profit from resale or refinancing.

- Minimal Risk: Tax liens are secure investments, typically attached to properties owned free and clear.

- Low Initial Investment: Most states have low minimum bid requirements, often as low as $100.

Maximize Returns:

- High-Interest Rates: Earn up to 18% interest on tax lien certificates in many states.

- Additional Rewards: Local governments may offer redemption fee discounts or future tax rebates.

- Ownership Opportunities: Gain property ownership at a fraction of its market value if the owner doesn’t redeem the lien.

Hedge Against Inflation: Tax liens appreciate over time, providing a valuable long-term investment.

Diversification: Expand your portfolio beyond stocks and bonds, reducing overall risk.

Start Small: Buy liens for as little as $500, making them perfect for budget-conscious investors.

In conclusion, investing in real estate tax liens offers a variety of advantages, from diversifying your portfolio to enjoying potential high returns. With the right strategy, they can significantly boost your profits. If you’re seeking a lucrative investment option, explore real estate tax liens – you could soon be reaping the rewards!

![]()

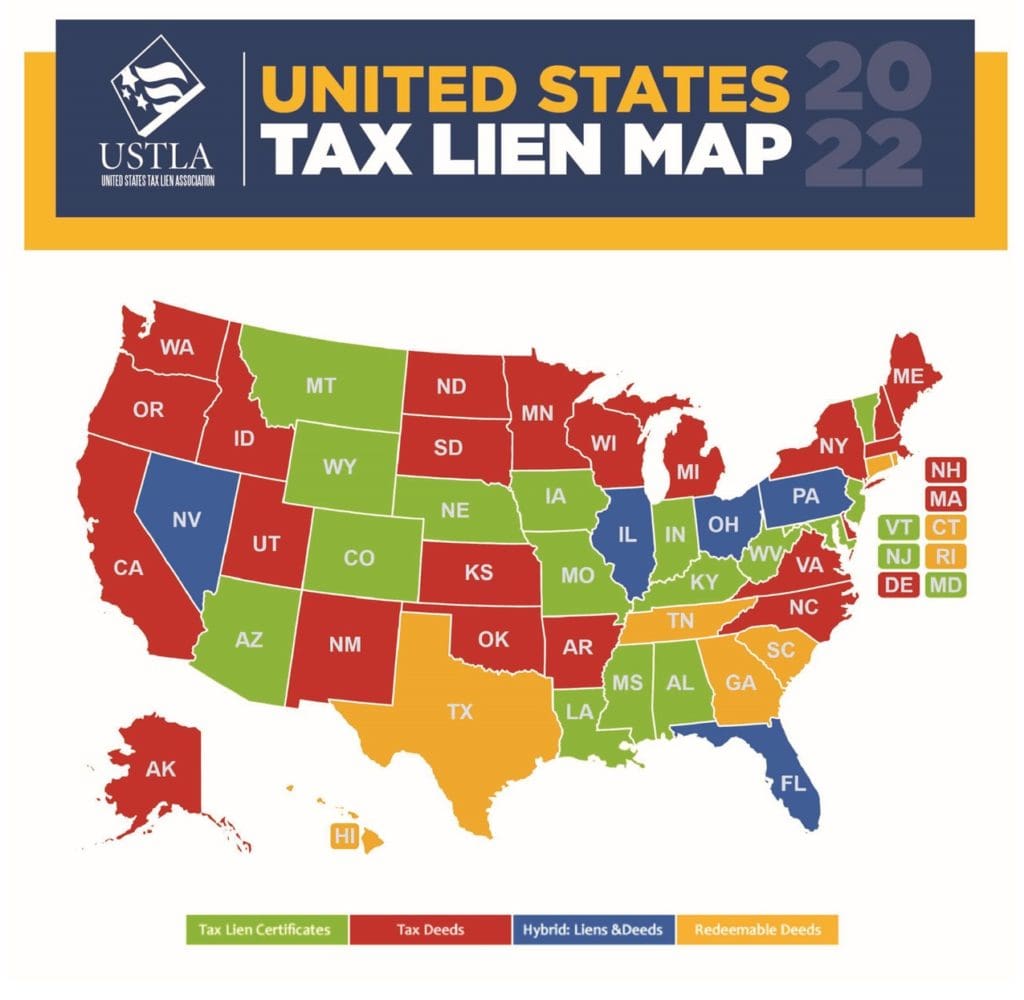

Tax Lien Certificates: A tax lien certificate is a certificate of claim against a property that has a lien placed upon it as a result of unpaid property taxes. Tax lien certificates are generally sold to investors through an auction process. –Investopedia

Tax Deeds: The term “tax deed” refers to a legal document granting ownership of a property to a government body when the owner fails to pay any associated property taxes. A tax deed gives the government agency the authority to sell the property to collect the delinquent taxes. Once sold, the property is then transferred to the purchaser. These transactions are called “tax deed sales” and are usually held at auctions. –Investopedia

Hybrid: Liens and Deeds: Hybrid systems are a combination of the tax lien and tax deed sales systems. In a hybrid system, you purchase the title at auction in the same way that you would purchase a tax deed, but as with a tax lien the original property owner has a redemption period that allows them to meet certain conditions to retain their property. –TaxSaleResources.com

Redeemable Deeds: Redemption deeds are a mixture of tax liens and deeds. Here we will look over redemption deed investing. Redemption deeds are tax deeds with a redemption period. You are buying real property, but the property owner gets one more chance to redeem or repurchase the property. The positive takeaway here is that the property owner has an attached penalty. Interest rates tend to be overly high for redemption deeds. –UnitedTaxLiens

What is ‘Tax Lien’

- A tax lien is a legal claim by a government entity against a noncompliant taxpayer‘s assets.

- If the taxes remain unpaid, the tax authority can then use a tax levy to legally seize the taxpayer’s assets in order to collect the money it is owed.

- The City then sells those tax liens to a third party.

Tax liens are a last resort to force an individual or business to pay back taxes. - Federal and state governments may place tax liens for unpaid federal or state income taxes, while local governments may place tax liens for unpaid local income or property taxes.

The Horror of a ‘Tax Lien’

- Tax liens take priority over virtually every other lien on a property, including a mortgage.

- Tax liens are publicly recorded and may be reported to credit agencies.

- These two features of tax liens effectively prevent the sale or refinancing of assets to which liens have been attached and prevent the delinquent taxpayer from borrowing money.

How To Get Rid Of A Tax Lien

- To get rid of a lien, the taxpayer must pay what he or she owes, get the debt dismissed in bankruptcy court or reach an offer in compromise with the tax authorities.

The Investment Opportunity

- Investors buy the liens in an auction, paying the amount of taxes owed in return for the right to collect back that money plus an interest payment from the property owner.

- That rarely happens

- Taxes are generally paid before the redemption date.

- The interest rates make tax liens attractive investments.

- If the redemption period passes and the taxes remain unpaid, the lien holder has the right to foreclose on the property.

- Not an easy task—the lien holder must file a lawsuit to get the title to the property, Cha Ching!!

- The payoff may or may not be worth it, especially if the property is damaged.

Connecticut Real Estate is Your real estate investment resource we will be adding a ton of free info and we are available as real estate consultants to help you through the process.

Steve Schappert Founded, and is the broker at Connecticut Real Estate, Schappert owns The Connecticut Art Gallery and Home & Art Magazine Steve also designed, built, and shipped a zero-energy double-walled home to Germany. Schappert is an abstract painting artist and has painted, renovated and provided energy audits for over 1300 homes.

When it comes to real estate, construction and energy efficiency, Steve Schappert is one of the most sought-after experts in the field. With more than 40 years of experience in these areas, he has become a trusted source for reporters looking for insights on the industry. From helping develop net-zero homes to advising on sustainable building practices, Schappert’s knowledge and expertise is unrivaled. Whether it’s for a news article or an in-depth magazine story, reporters turn to Steve Schappert as a reliable source of information. With his expertise and guidance, they can ensure that their stories are accurate and up-to-date.

In the last year I have been interviewed by ABC News Manhattan, Connecticut Magazine and featured in 2 articles in The Washington Post.

If you are looking for a creative broker that thinks outside the box and has been a recognized expert for over 30 years call or text 203-994-3950