the perfect loan for

veterans, active duty personnel, and military families

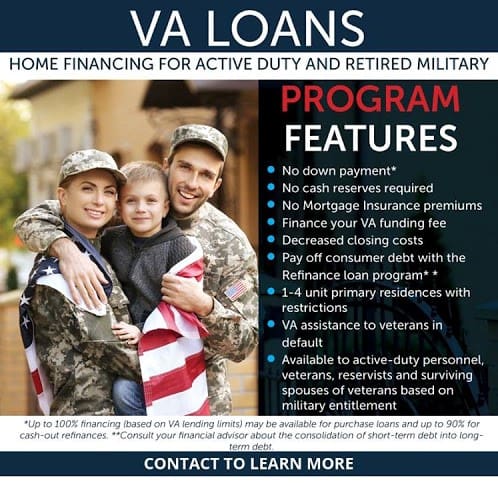

VA home loans are partially backed by the U.S. Department of Veterans Affairs and are available only to people who have served in the military and their surviving spouses. No exaggeration—this is the most flexible and affordable loan program out there. It’s easier to qualify for, generally has lower interest rates than conventional options, and offers some incredible benefits not available to the average consumer.

A 30-year fixed-rate VA loan is a great choice for those looking for a low monthly payment that won’t change.

the benefits

- No down payment required

- No monthly mortgage insurance, ever

- A lower than average credit score requirement

- Fixed rate, adjustable rate, and term length options available

the requirements

- You must have served 90 days during wartime

- Or, you have served 181 days during peacetime

- Or, you have served 6 years with the National Guard or Reserves

- Or, your spouse has died in the line of duty or due to a service-related disability

- Available for primary residences only

- A one-time funding fee will be rolled into the loan amount

APPLY NOW

Your Guide to VA Loans in Connecticut:

Your Guide to VA Loans in Connecticut:

Unlocking Homeownership for Veterans

Introduction: Are you a veteran with dreams of owning a home in Connecticut? Your path to homeownership is within reach. In this guide, we’ll explore VA loans—designed exclusively for veterans—and how they open doors to your American dream. With Connecticut Real Estate by your side, we’ll navigate the VA loan journey together.

Section 1: Understanding VA Loans

1.1 VA Loans Demystified: Your Path to Homeownership

- VA loans, offered exclusively to veterans, provide a unique opportunity to achieve homeownership. They are guaranteed by the U.S. Department of Veterans Affairs and come with advantages that set them apart from traditional mortgages. With no or low down payment requirements, competitive interest rates, and no private mortgage insurance (PMI), VA loans make homeownership attainable and affordable for veterans.

1.2 Advantages of VA Loans: Unlocking Your Benefits

- One of the standout advantages of VA loans is the ability to purchase a home with little to no down payment. This means you can become a homeowner without having to save up a large down payment, making the dream of homeownership more accessible. Additionally, VA loans typically come with competitive interest rates, often lower than conventional mortgages. This translates to lower monthly mortgage payments and significant savings over the life of your loan. Another benefit is the absence of private mortgage insurance (PMI), which can save you even more on monthly costs.

Section 2: The Connecticut Advantage

2.1 Why Connecticut?

- Connecticut offers a unique blend of natural beauty, rich cultural heritage, and abundant opportunities. Its diverse landscapes range from picturesque coastal towns to charming rural areas and vibrant cities. With a strong sense of community, excellent schools, and a thriving job market, Connecticut is an ideal place to call home for veterans and their families.

2.2 Local Real Estate Insights: Your Connecticut Real Estate Partner

- Navigating Connecticut’s housing market requires local knowledge and expertise. Connecticut Real Estate specializes in helping veterans find their dream homes in this diverse state. Our team understands the nuances of different neighborhoods, school districts, and housing options. We’re here to guide you every step of the way, ensuring you make an informed decision.

Section 3: The VA Loan Process

3.1 Eligibility and Requirements: Your Roadmap to Approval

- To secure a VA loan, you must meet specific eligibility criteria, including your service history and discharge status. You’ll also need to provide necessary documentation, such as your Certificate of Eligibility (COE). We’ll help you understand these requirements and ensure you have everything in order to move forward with confidence.

3.2 Pre-Approval Steps: Laying the Foundation for Success

- Pre-approval is a crucial step in your VA loan journey. It involves a comprehensive financial review to determine how much you can afford. Getting pre-approved not only strengthens your buying power but also demonstrates to sellers that you’re a serious and qualified buyer. We’ll walk you through this process, ensuring you’re well-prepared when you start your home search.

3.3 House-Hunting with VA Loans: Tips for Success

- Armed with your pre-approval, you’re ready to start house-hunting. Finding the perfect home that meets VA loan requirements involves considering factors like location, size, and condition. We’ll provide you with tips and resources to make your house-hunting experience as smooth as possible.

Section 4: Sealing the Deal

4.1 Making an Offer: Crafting a Winning Proposal

- Crafting a compelling offer is essential to secure your dream home. We’ll guide you on how to make a strong offer that aligns with VA loan conditions and increases your chances of acceptance by sellers. Our goal is to help you negotiate a favorable deal that suits your needs and budget.

4.2 Home Inspection and Appraisal: Ensuring a Fair Deal

- The VA appraisal process is designed to ensure that the property meets minimum safety and habitability standards. This protects your investment by identifying any potential issues. We’ll explain how this process works and how it benefits you as a homebuyer.

Section 5: Closing and Beyond

5.1 Closing the Deal: The Moment You’ve Been Waiting For

- Closing day is the culmination of your homebuying journey. We’ll walk you through what to expect, from reviewing the final paperwork to signing on the dotted line. It’s an exciting day when you officially become a homeowner.

5.2 Homeownership Bliss: Embracing Stability and Joy

- Homeownership brings stability, security, and the opportunity to create cherished memories. We’ll celebrate this milestone with you and help you transition into your new home with confidence.

Section 6: Why Choose Connecticut Real Estate

6.1 Local Experts at Your Service: Your Trusted Allies

- Connecticut Real Estate is committed to serving veterans throughout their homebuying journey. Our team consists of local experts who understand the unique needs and challenges veterans may face. We’re here to provide guidance, answer your questions, and ensure you have a smooth and successful homebuying experience.

6.2 Testimonials: Stories of Success

- Hear inspiring stories from veterans who achieved their homeownership dreams with Connecticut Real Estate and VA loans. These testimonials showcase our dedication to helping veterans like you achieve their homeownership goals. Coming Soon.

Conclusion: VA loans are a powerful tool designed to make homeownership a reality for veterans. Connecticut’s breathtaking landscapes, rich history, and vibrant communities provide the perfect backdrop for your new home. With Connecticut Real Estate’s expertise and unwavering support, you can embark on this exciting journey with confidence. Your dream home awaits – let’s unlock the door to your Connecticut homeownership together.

Resources

- VA Home Loan Eligibility and Requirements:

- Benefits of VA Loans:

- Connecticut Real Estate:

- Local Insights for Veterans:

- VA Loan Process:

- Sealing the Deal:

- Homeownership Bliss:

- Connecticut Real Estate Testimonials:

- Contact Information for Connecticut Real Estate:

- Connecticut Attractions:

Start The Home-Buying Process

with Steve Schappert 203-994-3950 Broker@ctreb.com