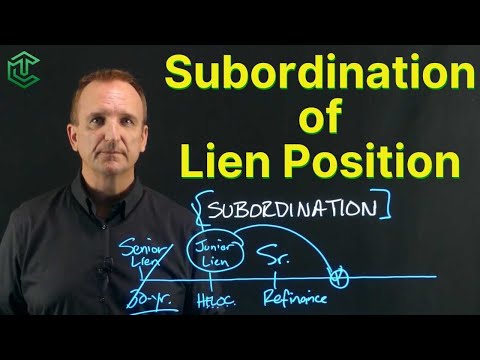

Mortgage subordination is a financial arrangement that involves changing the priority of existing mortgages or loans on a property. Subordination typically occurs when a borrower wants to take out a new loan or mortgage, and it affects the order in which creditors are paid if the borrower defaults on the loans. Here’s a detailed explanation of mortgage subordination:

1. Mortgage Priority:

- When a property is financed with multiple loans or mortgages, they have different priority levels, often determined by the order in which they were recorded. The loan recorded first is typically considered the primary or senior mortgage, while subsequent loans are junior or subordinate mortgages.

2. Subordination Agreement:

- Mortgage subordination involves obtaining a subordination agreement from the existing senior lender. This agreement allows a new loan or mortgage to take priority over the existing junior loans but remain subordinate to the senior loan. In essence, it changes the ranking of the loans.

3. Purpose of Subordination:

- Borrowers may seek subordination for various reasons, such as refinancing their primary mortgage, taking out a home equity line of credit (HELOC), or securing additional financing for home improvements or other purposes. Subordination ensures that the new lender’s lien takes precedence over the existing subordinate loans but remains behind the senior loan.

4. Subordination Process:

- The process typically involves the following steps:

a. The borrower applies for the new loan or mortgage.

b. The lender of the new loan contacts the existing senior lender to request a subordination agreement.

c. The existing senior lender reviews the request and assesses the impact on their interests.

d. If approved, the senior lender issues a subordination agreement that outlines the conditions and terms of the subordination.

5. Impact on Lenders:

- For the senior lender, subordination means that they agree to take a lower priority position in the event of default. This may involve higher risk, so the senior lender may consider factors such as the borrower’s creditworthiness and the impact on the overall loan-to-value (LTV) ratio.

- For the new lender, subordination allows them to secure their loan with the property’s equity, even if there are existing subordinate loans. It can make lending more attractive to borrowers and may lead to better loan terms.

6. Legal Implications:

- Subordination agreements are legally binding contracts that must be executed according to state and local laws. They often require the consent of all parties involved, including the borrower, the senior lender, and the new lender.

7. Documentation:

- Subordination agreements are typically recorded with the county or city where the property is located to provide a public record of the new lien priority.

Mortgage subordination is a complex financial arrangement that requires careful consideration and legal documentation. Borrowers, lenders, and existing lienholders should consult with legal and financial professionals to ensure that the subordination process is carried out correctly and to protect their interests.