Changing mortgage rates can have a significant impact on various aspects of the housing market and individual homeowners. Here are some key ways in which changing mortgage rates can influence the housing market:

- Affordability: Mortgage rates directly affect the affordability of homes. When mortgage rates are low, borrowers can secure loans at lower interest rates, resulting in lower monthly mortgage payments. This increased affordability can make homes more accessible to a broader pool of buyers and potentially stimulate demand in the housing market. Conversely, when mortgage rates rise, affordability decreases, and buyers may face challenges in purchasing homes, which can lead to a slowdown in demand.

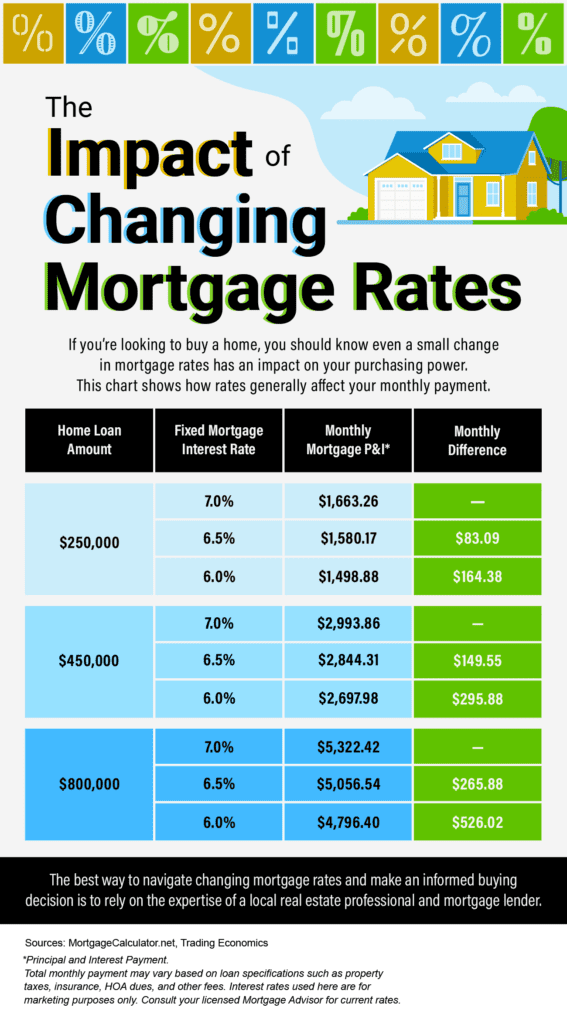

- Buying Power: Mortgage rates have a direct impact on buyers’ purchasing power. Lower interest rates enable buyers to qualify for larger loan amounts, allowing them to consider more expensive homes or have more flexibility in their budget. When rates increase, buyers’ purchasing power diminishes, as higher rates mean higher monthly mortgage payments for the same loan amount. This can limit the options available to buyers and potentially lead to a decrease in home prices if demand weakens.

- Refinancing Activity: Changing mortgage rates can significantly influence refinancing activity. When rates drop, homeowners may choose to refinance their existing mortgages to secure lower interest rates and potentially reduce their monthly payments. Refinancing can provide homeowners with cost savings and financial flexibility. Conversely, when rates rise, the incentive to refinance diminishes, and refinancing activity tends to decline, impacting the mortgage industry and overall housing market activity.

- Inventory Levels: Mortgage rates can indirectly impact the supply of homes on the market. When rates are low, existing homeowners may be more reluctant to sell and lose their favorable interest rates. This reduced willingness to sell can lead to a decrease in housing inventory, resulting in a more competitive market and potentially driving up home prices. Conversely, as rates increase, more homeowners may decide to sell and capitalize on the current market conditions, leading to an increase in inventory levels and potentially moderating price growth.

- New Construction: Changing mortgage rates can also influence new construction activity. Lower interest rates can make it more attractive for developers and builders to obtain financing for new projects. This can lead to increased construction activity and the availability of newly built homes. On the other hand, higher rates can discourage new construction as the cost of borrowing increases, potentially impacting the housing supply and market dynamics.

It’s important to note that the relationship between mortgage rates and the housing market can be complex and influenced by various other factors, such as the overall economy, employment trends, and consumer confidence. Additionally, the impact of changing mortgage rates can vary by region and market conditions. Staying informed about current mortgage rates and working with mortgage professionals and real estate experts can help buyers, sellers, and homeowners make informed decisions in response to changing market conditions.

If you’re looking to buy a home, you should know even a small change in mortgage rates has an impact on your purchasing power.