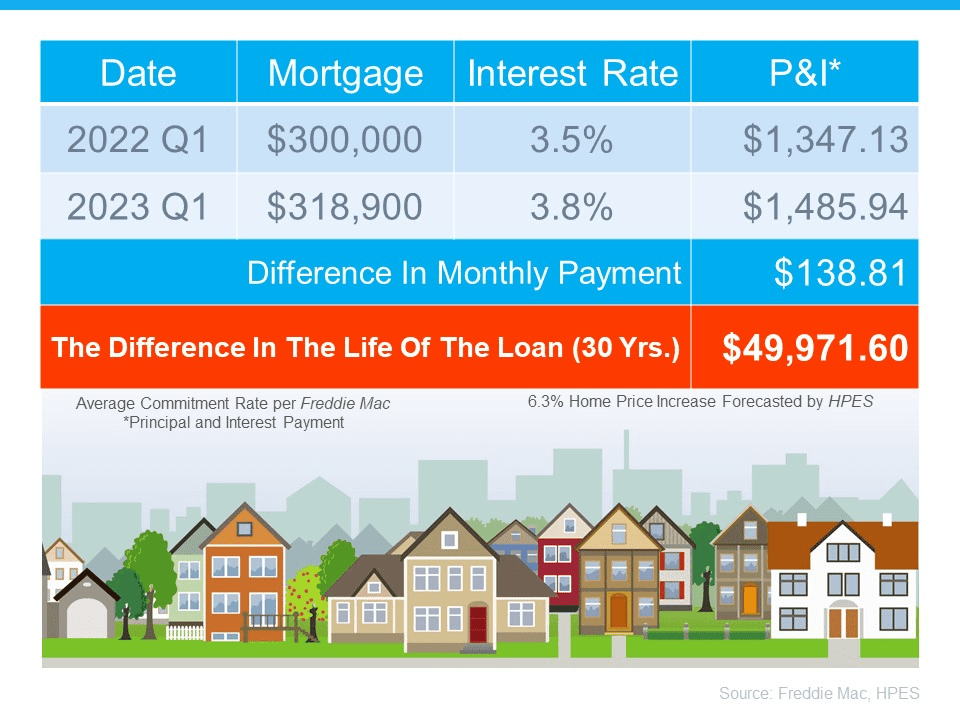

Make sure you know the impact of rising mortgage rates and prices on your monthly mortgage payment.

This image shows you how monthly mortgage payments will increase as mortgage rates and home prices rise. Experts are currently projecting continued home price appreciation and a rise in mortgage rates. This means it will cost more to buy a home if your clients wait.

The scenario you’ve described, where mortgage payments, interest rates, and home prices rise while retirement funds dwindle, can be a challenging one for individuals approaching retirement or those who are already retired. Let’s break down the potential consequences and some strategies to navigate this situation:

- Higher Mortgage Payments:

- If you still have a mortgage on your home as you approach retirement, rising mortgage payments can strain your finances. It’s essential to plan for these increases and explore options to mitigate them.

- Refinancing: Consider refinancing your mortgage to secure a lower interest rate or switch to a fixed-rate mortgage if you have an adjustable-rate mortgage (ARM). This can provide stability in your monthly payments.

- Downsizing: If your home is too large or expensive to maintain, downsizing to a more affordable property can reduce your mortgage payments and ongoing expenses.

- Rising Interest Rates:

- When interest rates increase, it affects both mortgage rates and the returns on conservative investments like bonds or savings accounts. This can impact your income and the cost of borrowing.

- Diversify Investments: If you have retirement savings, consider diversifying your portfolio to include a mix of assets that can weather rising interest rates, such as stocks, real estate investment trusts (REITs), and inflation-protected securities.

- Pay Off High-Interest Debt: Reducing high-interest debt, such as credit card balances, can free up more funds for essential expenses, including housing.

- Increasing Home Prices:

- Rising home prices can be a double-edged sword. While they can potentially increase your home’s value, they can also make it challenging to afford a new home if you’re considering downsizing.

- Consider Home Equity: If your home’s value has appreciated significantly, you might explore options to tap into your home equity, such as a home equity line of credit (HELOC) or reverse mortgage. Be cautious with these options and understand the terms and potential risks.

- Dwindling Retirement Funds:

- If your retirement savings are dwindling, it’s crucial to adjust your retirement plan and budget accordingly.

- Budgeting: Create a detailed budget that accounts for your current financial situation. Prioritize essential expenses, including housing, healthcare, and basic living needs.

- Work with a Financial Advisor: Consult with a financial advisor or planner who specializes in retirement planning. They can help you make informed decisions about managing your retirement funds, investments, and long-term financial goals.

- Part-Time Work or Alternate Income Streams:

- Consider part-time work, freelance gigs, or alternate income streams to supplement your retirement income. This can help offset rising costs and ensure financial stability.

- Government Assistance Programs:

- Research government programs or assistance options for retirees. Some programs may provide financial support, especially for housing-related expenses or healthcare.

- Explore Housing Alternatives:

- If your current home becomes unaffordable or unsuitable for your retirement needs, explore other housing options, such as renting, moving to a more affordable area, or considering senior living communities.

Navigating the challenges of rising mortgage payments, interest rates, and home prices while managing dwindling retirement funds requires careful planning, flexibility, and potentially adjusting your expectations and lifestyle to match your financial reality. Consulting with financial professionals and exploring available resources can help you make informed decisions during this period.

Don’t wait, call or text Steve Schappert now and get in the game. 203-994-3950