Americans See Real Estate as a Better Investment Than Stocks or Gold! Last month, in a post on the Liberty Street Economics blog, the Federal Reserve Bank of New York noted that Americans believe buying a home is definitely or probably a better investment than buying stocks. Last week, a Gallup Poll reaffirmed those findings.

In an article on the current real estate market, Gallup reports:

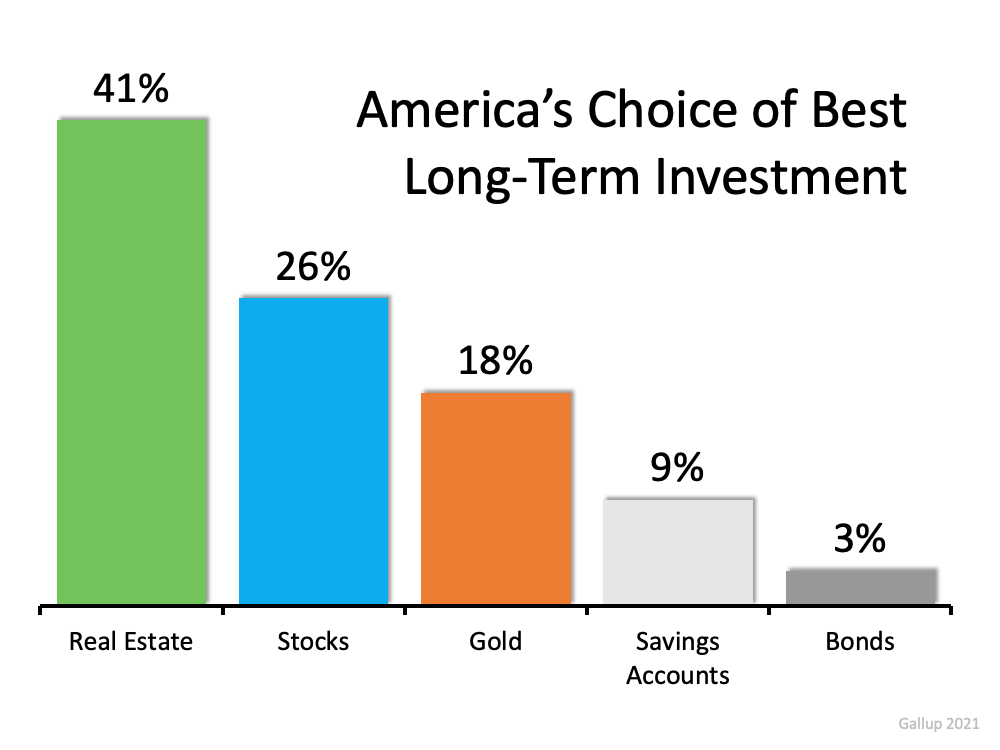

“Gallup usually finds that Americans regard real estate as the best long-term investment among several options — seeing it as superior to stocks, gold, savings accounts and bonds. This year, 41% choose real estate as the best investment, up from 35% a year ago, with stocks a distant second.”

Here’s the breakdown:

“The 41% choosing real estate is the highest selecting any of the five investment options in the 11 years Gallup has asked this question.”

Is Real Estate Really a Secure Investment Right Now?

Some question American confidence in real estate as a good long-term investment right now. They fear that the build-up in home values may be mirroring what happened right before the housing crash a little more than a decade ago. However, according to Merrill Lynch, J.P. Morgan, Morgan Stanley, and Goldman Sachs, the current real estate market is strong and sustainable.

As Morgan Stanley explains to their clients in a recent Thoughts on the Market podcast:

“Unlike 15 years ago, the euphoria in today’s home prices comes down to the simple logic of supply and demand. And we at Morgan Stanley conclude that this time the sector is on a sustainably, sturdy foundation. This robust demand and highly challenged supply, along with tight mortgage lending standards, may continue to bode well for home prices. Higher interest rates and post-pandemic moves could likely slow the pace of appreciation, but the upward trajectory remains very much on course.”

This perspective is echoed by other major institutions. J.P. Morgan highlights the demographic shifts that are driving new household formations, especially among Millennials and Gen Z buyers. With more people entering the housing market and fewer homes available, competition remains fierce. Meanwhile, lending practices are significantly stricter than they were prior to the 2008 crash. Borrowers must meet higher credit standards, provide larger down payments, and demonstrate greater financial stability. These safeguards reduce the risk of widespread defaults, which was a major contributor to the last housing crisis.

Additionally, unlike the speculative overbuilding of the early 2000s, today’s builders are struggling to keep up with demand due to labor shortages, supply chain disruptions, and rising material costs. This imbalance between supply and demand is a key factor keeping prices elevated. While rising mortgage rates have tempered affordability for some buyers, others see homeownership as a hedge against inflation and a way to build generational wealth.

Real estate also continues to stand out when compared to alternative investments. Stocks can be volatile, and inflation chips away at the value of cash savings. Homeownership, on the other hand, provides not only potential appreciation but also utility—you live in and enjoy the property while it grows in value. In fact, surveys consistently show that Americans view real estate as the most reliable long-term investment, often ranking it above stocks, bonds, and gold.