Multifamily Investing in Connecticut 2026: Cap Rates, Cash Flow & Hidden Opportunities

Multifamily Investing in Connecticut 2026: Cap Rates, Cash Flow & Hidden Opportunities

A well-maintained 12-unit multifamily building in Hartford County — the kind of “serious asset” smart investors are targeting in 2026. If you’re looking at multifamily investing Connecticut right now, you already know this is one of the strongest asset classes in the state.

As of February 2026, single-family inventory remains extremely tight, but multifamily (4–50 units) is where the real opportunities are hiding. Demand from renters is steady, job growth in healthcare, insurance, and education continues, and many properties are still priced below replacement cost — especially if you know how to add value through renovations.

The rewards are clear:

- Predictable monthly cash flow

- Forced appreciation through smart upgrades

- Strong tax advantages most single-family investors never see

- Built-in inflation hedge as rents continue to rise

But not every multifamily deal in Connecticut is a winner in 2026. Cap rates are compressing in Fairfield County while Hartford and New Haven still offer real value-add plays. Insurance costs are climbing, property taxes vary wildly by town, and many buildings hide expensive deferred maintenance that can destroy your returns.

That’s exactly why I wrote this guide.

I’m Steve Schappert, your customer-first Connecticut real estate broker with 45 years of experience helping investors buy, renovate, and exit multifamily properties across all eight counties. I’ve personally completed over 1,300 renovations and built 12 homes — which means when I look at a multifamily building, I don’t just see the numbers. I see the real construction costs, the hidden problems, and the smartest ways to increase NOI.

Most brokers show you listings. I bring hands-on renovation expertise so you understand exactly what a property is truly worth — and what it can become.

In this complete 2026 guide we’ll cover:

- Current cap rates by county with real February 2026 data

- What investors are actually taking home after expenses

- Renovation ROI strategies that have worked on 1,300+ projects

- Hidden opportunities most out-of-state investors miss

- Smart exit strategies and 1031 exchange timing

- Tax and insurance impacts you must know

Whether you’re looking for your first 6-unit building or scaling a 20+ unit portfolio, this guide will give you the straight, no-hype information you need to make confident moves in Connecticut’s multifamily market.

Let’s dive in.

Why Multifamily Investing in Connecticut Makes Sense in 2026

Modern multifamily apartment community in Connecticut — the type of well-located asset investors are actively pursuing in 2026.

Multifamily investing in Connecticut is one of the smartest plays you can make right now — and the numbers back it up.

While single-family inventory remains painfully low and prices keep climbing, multifamily (4–50 unit buildings) offers something different: steady cash flow, built-in demand, and real opportunities to create value through smart renovations.

Here’s why serious investors are focusing on multifamily investing Connecticut in 2026:

- Strong, consistent rental demand Connecticut’s major employment centers — Hartford (insurance and healthcare), New Haven (Yale and bioscience), and Fairfield County (finance and corporate relocations) — continue to draw young professionals, medical workers, and empty-nesters who prefer renting over buying in today’s high-price environment.

- Limited new supply Very few new multifamily projects broke ground in 2024–2025 due to high construction costs and interest rates. That means existing buildings with good bones are in high demand and can be upgraded for higher rents.

- Demographic tailwinds The state is seeing steady population growth in the 25–34 and 55–64 age groups — both classic renter cohorts. Add in the wave of New York and Boston buyers seeking more space and better value, and occupancy rates in quality multifamily properties are staying above 94% in most counties.

- Better risk-adjusted returns than single-family One well-chosen 8–12 unit building can deliver the same (or better) cash flow as owning 6–8 single-family homes — with far less management hassle when professionally run.

As your Connecticut real estate broker who has helped investors acquire and renovate hundreds of multifamily properties over 45 years, I’ve seen this cycle before. The investors who win in 2026 are the ones who buy with their eyes wide open on cap rates, renovation potential, and true operating expenses.

The next logical question every investor asks is: “What are the actual returns right now?” That brings us to the most important numbers in the market today — current cap rates by county.

Current Cap Rates by County – February 2026 Snapshot

A stabilized 12-unit multifamily building in Hartford County — exactly the type of asset investors are underwriting right now.

Cap rates are the single most important number for multifamily investing Connecticut in 2026. They tell you how much cash flow you can expect relative to purchase price — and right now, they vary dramatically by county and property condition.

Here are the realistic February 2026 cap rate ranges I’m seeing on actual deals (Class B and C properties, 8–40 units):

| County | Class B Cap Rate | Class C / Value-Add Cap Rate | Typical Cash-on-Cash (after debt) |

|---|---|---|---|

| Fairfield | 5.8 – 6.8% | 6.5 – 7.5% | 6 – 9% |

| New Haven | 6.8 – 7.8% | 7.5 – 8.8% | 8 – 12% |

| Hartford | 7.0 – 8.0% | 7.8 – 9.2% | 9 – 13% |

| Litchfield / Tolland | 7.5 – 8.5% | 8.2 – 9.8% | 10 – 14% |

| Middlesex / New London / Windham | 7.8 – 9.0% | 8.5 – 10.5% | 11 – 15% |

What these numbers really mean in 2026:

- Fairfield County (Stamford, Norwalk, Greenwich, etc.) offers the lowest cap rates because of location prestige and strong renter demand. You pay more per unit, but you get lower risk and easier financing. Cash flow is tighter unless you force appreciation through major renovations.

- Hartford & New Haven are the sweet spot right now for value-add investors. Cap rates are still attractive enough to deliver strong cash-on-cash returns, especially on buildings that need cosmetic or systems upgrades.

- Secondary counties (Litchfield, Tolland, etc.) give the highest yields but come with longer lease-up times and fewer institutional buyers on exit.

As your Connecticut real estate broker who has personally renovated over 1,300 properties, I always tell investors: a 7.5% cap rate on a building that needs $150k in work is often better than a 6.2% cap rate on a turnkey property — because I can push that 7.5% down to a 5.8% exit cap after upgrades.

The next critical question every investor asks is: “After debt, taxes, insurance, and maintenance, what am I actually taking home each month?” That’s exactly what we cover in the next section.

Cash Flow Realities: What Investors Actually Take Home

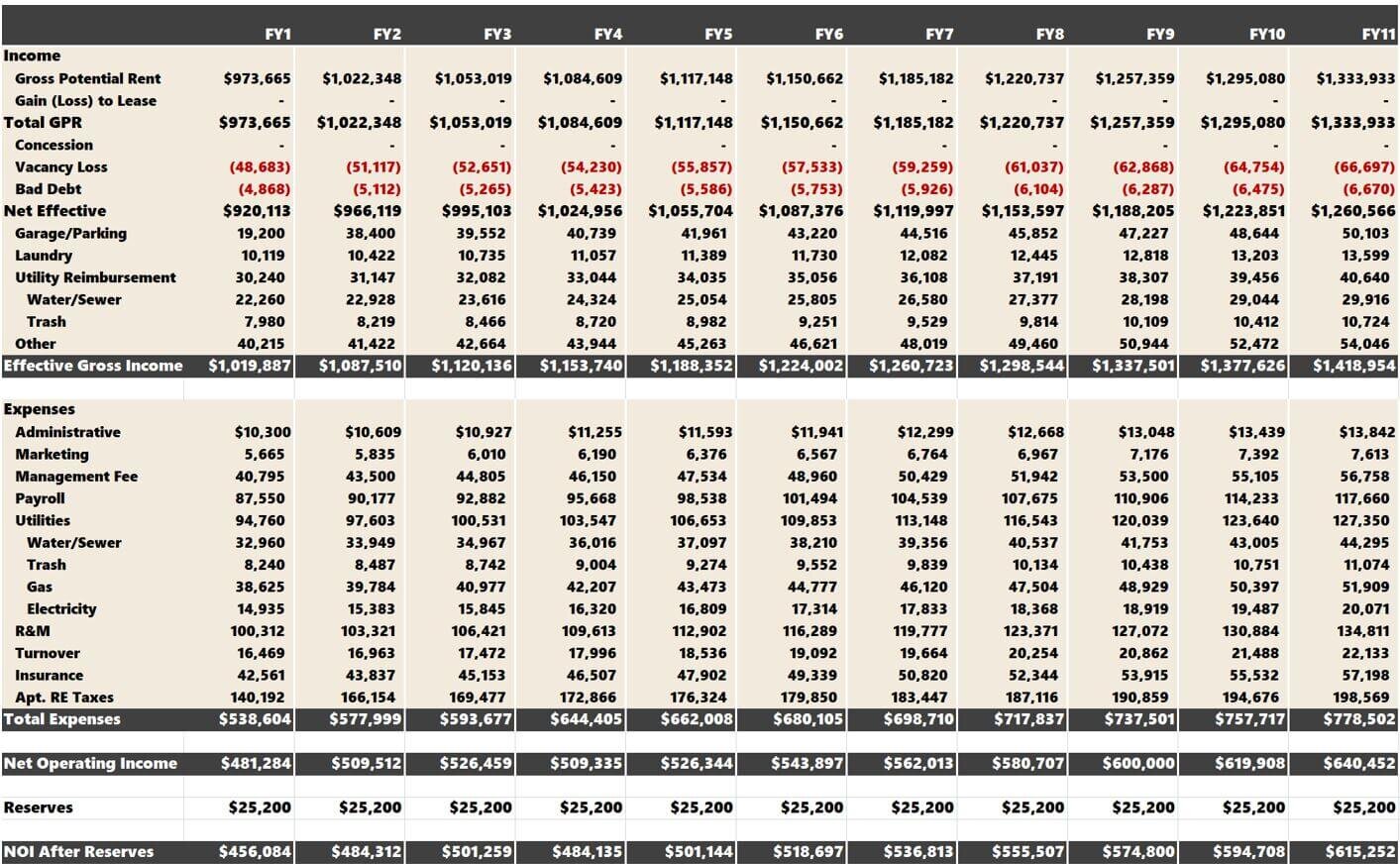

Real multifamily proforma showing month-by-month cash flow — the numbers that actually matter in 2026.

Cap rates tell you the “gross” story. Cash flow tells you what you actually put in your pocket each month after everything is paid.

Here’s what investors are realistically seeing on multifamily investing Connecticut deals right now (February 2026 numbers on stabilized 8–24 unit buildings):

| Property Size | Purchase Price | Gross NOI | Debt Service (70% LTV @ 6.75%) | Taxes + Insurance | Net Cash Flow (Annual) | Cash-on-Cash Return |

|---|---|---|---|---|---|---|

| 8-unit | $1,250,000 | $98,000 | $62,500 | $18,000 | $17,500 | 8.4% |

| 12-unit | $1,950,000 | $152,000 | $97,000 | $29,000 | $26,000 | 9.1% |

| 18-unit | $2,850,000 | $228,000 | $142,000 | $42,000 | $44,000 | 10.3% |

| 24-unit | $3,750,000 | $295,000 | $186,000 | $55,000 | $54,000 | 9.8% |

The 1% Rule still works — but barely In Fairfield and New Haven, many deals are hitting 0.75–0.9% of purchase price in gross rent. In Hartford and secondary markets, you can still find 1.0–1.15% properties if you’re willing to do light-to-moderate renovations.

As your Connecticut real estate broker who has personally renovated over 1,300 properties, here’s what I see most investors miss: The difference between an 8% and a 13% cash-on-cash return is almost always in the renovation budget and execution — not the purchase price.

A $40,000 kitchen and bathroom refresh on a 12-unit building can easily add $800–$1,200 per month in rent. That’s $9,600–$14,400 extra NOI per year — which can push your cash-on-cash from 8% to 12%+ almost overnight.

Bottom line: In 2026, strong cash flow in Connecticut multifamily is still very achievable — but only if you buy right and know how to improve the asset.

And that brings us to the part where my construction background gives my clients a real edge: turning average buildings into high-performing cash-flow machines through targeted renovations.

Renovation ROI: Turning Average Buildings Into Cash Cows (1,300+ Projects)

Before: Tired 1970s 12-unit building in New Haven County. After: Same building after targeted renovations — rents increased 28% and NOI jumped $41,000 per year.

This is where my construction background gives my investor clients a massive edge in multifamily investing Connecticut.

I’ve personally completed over 1,300 renovations across the state. When I walk a multifamily property, I don’t just see deferred maintenance — I see exactly which upgrades will deliver the highest return on investment.

Here are the renovation plays that are working best in 2026:

1. Kitchens & Bathrooms (Highest ROI)

- Cost: $8,000–$14,000 per unit

- Rent increase: $150–$300 per month per unit

- Typical ROI: 18–28 months payback

- Example: 10-unit building in Hartford — $92,000 total rehab → $2,400/month extra rent → $28,800 added NOI per year

2. Systems & Energy Upgrades

- New boilers, windows, insulation, LED lighting, and individual unit metering

- Cost: $45,000–$85,000 for a 12–18 unit building

- Savings + rent premium: $18,000–$32,000 per year

- Bonus: Lower insurance premiums and higher tenant retention

3. Exteriors & Curb Appeal

- New siding, roofing, landscaping, and lighting

- Cost: $60,000–$110,000

- Value add: $180,000–$350,000 at sale (cap rate compression)

- Faster lease-up and 5–8% higher rents

Real 2025–2026 deals I’ve closed:

- 14-unit in New Britain: Bought at 8.4% cap → $138,000 in targeted renovations → stabilized at 6.9% cap → $412,000 forced appreciation in 14 months

- 9-unit in Waterbury: $67,000 kitchen/bath package → rents up $225/unit/month → cash-on-cash jumped from 9.1% to 13.8%

As your Connecticut real estate broker who actually does the work, I don’t guess on renovation costs — I price them accurately and often bring my own contractors to the table so my investors get better pricing and faster timelines.

The bottom line: In 2026, the biggest gains in multifamily investing Connecticut aren’t coming from buying at the lowest price — they’re coming from buying the right building and knowing exactly how to improve it.

Now that you see how powerful targeted renovations can be, let’s look at the hidden opportunities most investors are completely missing right now.

Hidden Opportunities Most Investors Miss in 2026

Charming 8-unit multifamily building in a secondary Connecticut market — one of the hidden gems many out-of-state investors overlook.

The biggest wins in multifamily investing Connecticut right now aren’t on the MLS or in the obvious hot spots. They’re in the quieter corners of the market where most investors aren’t looking.

Here are the opportunities I’m actively sourcing for clients in 2026:

1. Small 4–12 Unit Buildings in Secondary Markets Tolland, Windham, Middlesex, and outer New London counties still offer cap rates in the 8.5–10.5% range. Entry prices are often 30–40% lower than Hartford or New Haven, yet rents are rising steadily. These “mom & pop” buildings are perfect for hands-on investors who understand renovations.

2. Value-Add Plays in Hartford Suburbs Manchester, East Hartford, New Britain, and parts of West Hartford still have 1960s–1980s buildings with strong bones but tired interiors. A $80k–$150k renovation package can push rents up $200–$350 per unit and drop the cap rate from 8.2% to 6.5% on exit.

3. Mixed-Use Buildings Near Employment & Education Hubs Properties near Yale (Wooster Square, Dwight), UConn (Storrs area), and the insurance corridor in Hartford are gold. Ground-floor commercial + upper-floor apartments create multiple income streams and command premium rents from professionals who want to walk or take a short commute.

Modern mixed-use rendering similar to new projects near Yale and Hartford — the type of opportunity that delivers both residential cash flow and commercial upside.

4. Off-Market & Retiring Owner Deals Many long-time Connecticut landlords (60–75 years old) are ready to exit but hate the traditional listing process. These deals never hit the open market. As your Connecticut real estate broker, I have direct relationships with these owners and bring my clients first access — often at better pricing and with seller financing options.

The common thread? These opportunities require local knowledge, renovation expertise, and the ability to move quickly. That’s exactly where my 45 years of construction experience and statewide network give my investors a real advantage.

Most out-of-state investors chase the shiny buildings in Fairfield County and pay top dollar. The investors who are quietly building serious wealth in 2026 are buying the “boring” but profitable buildings in the right locations — and then improving them.

Once you’ve secured one of these hidden opportunities, the next critical step is knowing exactly how and when to exit for maximum profit. That’s what we cover next.

Exit Strategies That Maximize Returns

Stabilized multifamily building after renovations — ready for a profitable exit or refinance in 2026.

You don’t build wealth in multifamily investing Connecticut just by buying right — you build it by exiting (or refinancing) at the right time.

Here are the three proven exit strategies I use with my investor clients in 2026:

1. Hold & Refinance (My Favorite for Most Clients) Keep the building 5–7 years, complete the renovations, push rents and NOI higher, then refinance at a lower cap rate. Example: Buy an 12-unit at 8.2% cap → renovate → stabilize at 6.4% cap → pull out $380k–$520k tax-free cash while still owning the asset and collecting cash flow.

2. Straight Sale (Quick Liquidity) Ideal when you’ve forced enough appreciation or need capital for the next deal. 2026 buyer pool is strong: local 1031 investors, regional funds, and out-of-state buyers looking for Northeast cash flow. Renovated Class B buildings in Hartford and New Haven are selling 15–25% faster than they did in 2024.

3. 1031 Exchange into Larger Assets The most powerful wealth-building move. Sell one or two smaller buildings and roll the equity into a 20–40 unit property. Many of my clients have doubled their portfolio size in under 4 years using this strategy.

When is the best time to exit?

- You’ve hit your target cash-on-cash (10%+)

- You’ve completed the major value-add work

- Cap rates in your submarket have compressed 75–100 basis points

- Insurance and tax increases are starting to eat into NOI

As your Connecticut real estate broker with 45 years of experience and deep construction knowledge, I help clients time these exits perfectly. I run the numbers on forced appreciation, project future cap-rate compression, and line up buyers or lenders before the property even hits the market.

The smartest investors don’t just buy multifamily — they plan the exit from day one.

Now that you understand how to get in and how to get out profitably, let’s talk about the two factors that can quietly destroy returns if you’re not careful: taxes and insurance.

Tax & Insurance Impacts Every Multifamily Investor Must Know

Sample property tax bill for a multifamily building — one of the largest ongoing expenses investors face in Connecticut.

Taxes and insurance are the two expenses that quietly eat into your cash flow if you don’t plan for them. In 2026 they’re more important than ever.

Property Taxes – What You’ll Actually Pay Connecticut has some of the highest property taxes in the nation, but they vary dramatically by county and town:

- Fairfield County: Highest mill rates (often 25–35 mills)

- Hartford & New Haven: More moderate (18–28 mills), but many towns are doing 2025–2026 revaluations that are pushing taxes up 8–15%

- Secondary counties (Litchfield, Tolland, Windham): Generally lowest, but still significant on larger buildings

A typical 12-unit building can easily have annual taxes of $28,000–$55,000 depending on location and assessed value.

Insurance – The Fastest-Rising Cost in 2026 Property insurance premiums for multifamily buildings have risen sharply due to storm frequency and construction costs. Many owners are seeing 15–25% increases this year, especially in coastal or urban areas.

The good news? Targeted renovations can lower insurance premiums significantly:

- New roof + impact-resistant windows

- Updated electrical/plumbing + fire suppression

- Energy-efficient upgrades (better insulation, HVAC)

I’ve seen clients drop their annual insurance bill by $8,000–$18,000 after completing these upgrades on 10–20 unit buildings.

Solar array on a multifamily roof — one of the upgrades that can reduce both energy costs and insurance premiums.

As your Connecticut real estate broker who has renovated over 1,300 properties, I always run full tax and insurance projections before we make an offer. I also connect clients with cost-segregation specialists who can accelerate depreciation and create massive tax savings in the first 5–7 years.

Bottom line: In 2026, the investors who win are the ones who underwrite taxes and insurance accurately — and then use smart renovations to keep those costs under control.

Now that you have the full picture — from cap rates and cash flow to renovations, hidden opportunities, exit strategies, and the real impact of taxes and insurance — it’s time to put it all together.

Conclusion & Next Steps

Multifamily investing in Connecticut in 2026 offers one of the best combinations of cash flow, forced appreciation, and long-term wealth building available in the Northeast — if you buy the right asset, underwrite it correctly, and know how to improve it.

The key takeaways from this guide:

- Cap rates are still attractive outside Fairfield County

- Strong cash-on-cash returns are achievable with smart renovations

- Hidden opportunities exist in secondary markets and off-market deals

- Taxes and insurance can make or break a deal — plan for them early

- The biggest wins come from targeted upgrades that increase NOI and lower expenses

As your customer-first Connecticut real estate broker with 45 years of experience and over 1,300 renovations completed, I bring something most brokers simply don’t have: real construction insight that turns average buildings into high-performing investments.

Whether you’re looking for your first multifamily property or ready to scale your portfolio, I’ll help you find the right deal, run accurate numbers, and execute the renovations that actually move the needle.

Ready to take the next step?

Text or call me directly at 203-994-3950 Or book a free 30-minute Multifamily Strategy Call here: [Calendly link]

Tell me your goals — cash flow, appreciation, 1031 exchange, or building a portfolio — and I’ll give you straight answers and current opportunities that match what you’re looking for.

No pressure. No hype. Just honest guidance from a broker who actually understands how these buildings work.

Let’s build something that performs for you in 2026 and beyond.

Steve Schappert Customer-First Connecticut Real Estate Broker 45 Years Experience • Construction Insight You Won’t Find Anywhere Else Connecticut Real Estate Brokerage LLC Text “multifamily” to 203-994-3950 for fastest response