The Power of Mortgage Pre-Approval [INFOGRAPHIC]

Some Highlights

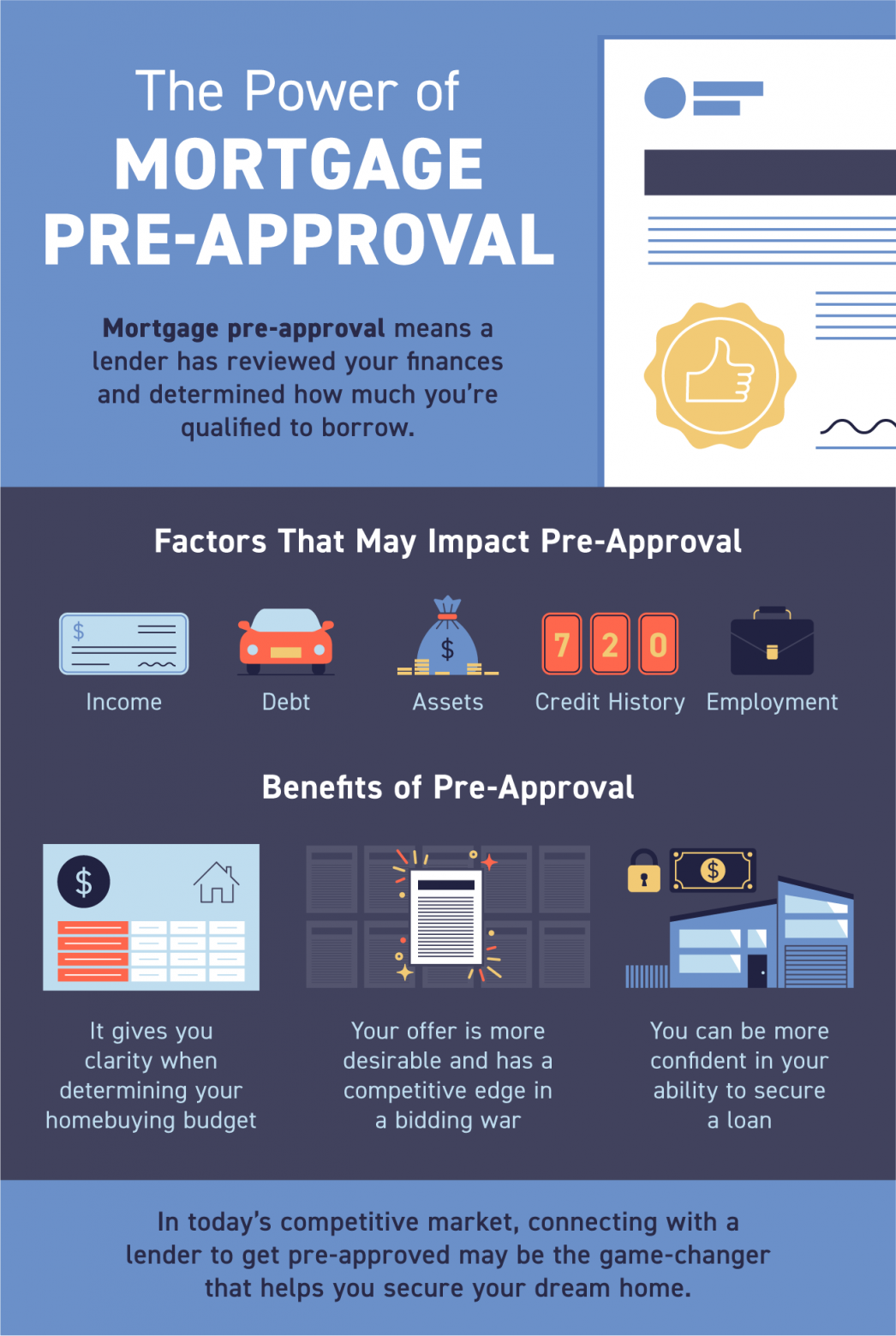

Mortgage pre-approval means a lender has reviewed your finances and, based on factors like your income, debt, and credit history, determined how much you’re qualified to borrow. Being pre-approved for a loan can give you clarity while planning your homebuying budget, confidence in your ability to secure a loan, and a competitive edge in a bidding war. In today’s market, connecting with a lender to get pre-approved may be the game-changer that helps you secure your dream home.

Hello, my name is Steve Schappert, and I am the Connecticut Real Estate Broker. I treat people honestly, look them in the eye, and ask for their trust. Then day after day, I earn it. All the fanfare and hype doesn’t sell houses—listening sells houses. Listening to your client’s wants and needs, and helping them make intelligent decisions based on enough solid data that allows the heart to make emotional decisions.

I’ve spent decades in the Connecticut market, helping buyers, sellers, and investors navigate real estate with confidence. From understanding financing options to negotiating the best deal, my mission is to protect your interests every step of the way. Whether you’re a first-time homebuyer, upgrading to fit your family’s lifestyle, or downsizing for a simpler life, I provide the knowledge and guidance you need to succeed. Real estate is more than transactions—it’s about relationships, trust, and creating opportunities for your future.

Call or text my cell 24/7 203-994-3950 or email me at [email protected]. Visit our website at https://connecticutrealestate.online.