The desire to own a home is strong.

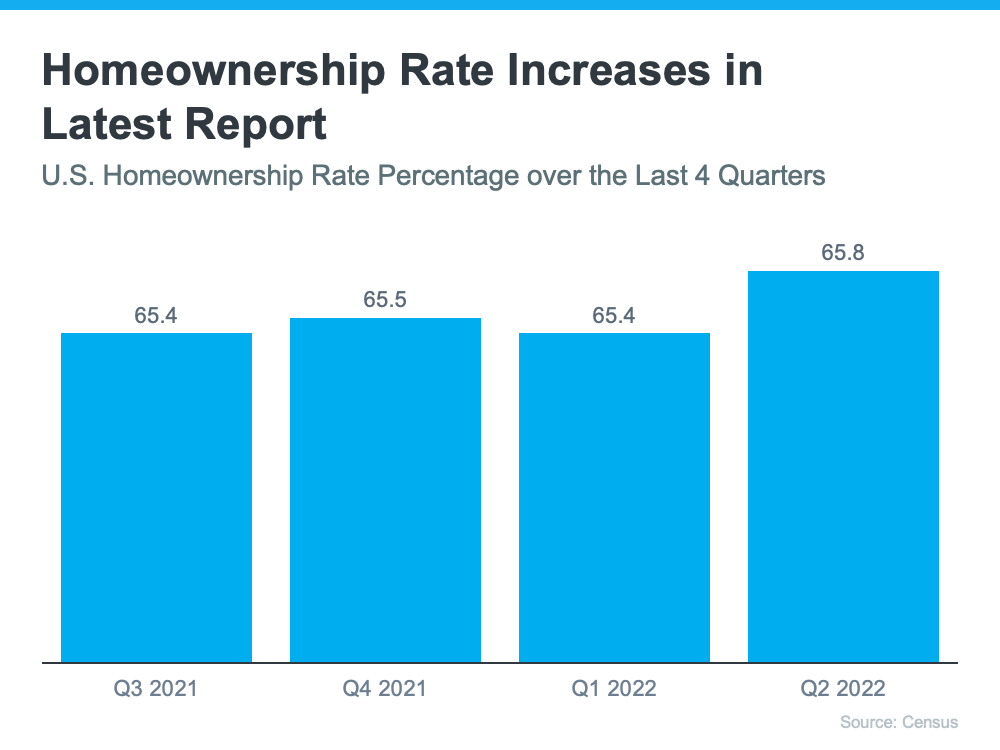

In fact, according to the HUD and the Census, the U.S. homeownership rate is on the rise. To illustrate the increase, the graph below shows the homeownership rate over the last year:

That data shows more than half of the U.S. population live in a home they own, and the percentage is growing with time.

People thinking about buying a home this year must see the value with homeownership.

Why Are More People Becoming Homeowners?

There are several benefits to owning your home. A significant one, especially when inflation is high like it is today, is that homeownership can help protect you from rising costs. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“In the 1970s, when inflation was running around 10%, home prices were rising at approximately the same rate. Renters actually have a harder time in inflationary periods, because rents tend to rise along with inflation, whereas mortgage payments stay the same for homeowners with fixed-rate mortgages.”

That gives you a predictable monthly housing expense which benefits you in the short term, plus that will grow because your home appreciates in value as you meet those monthly mortgage payment.

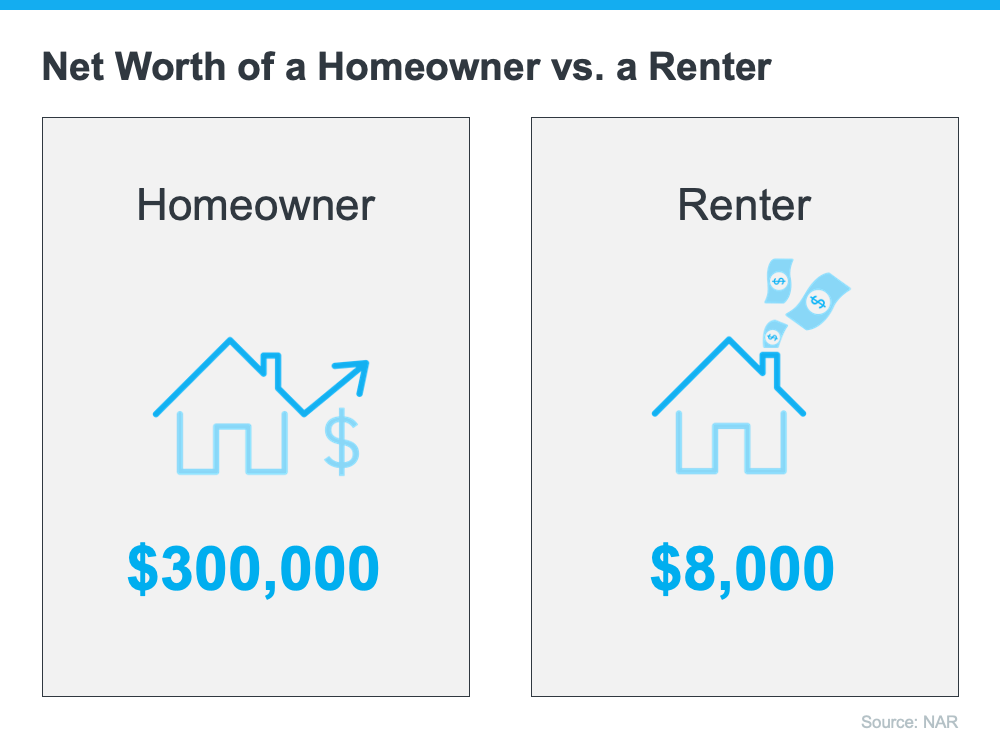

And with that growing equity, your net worth will increase as well. In fact, the latest data from NAR estimates the median household net worth of a homeowner is roughly $300,000, while the median net worth of renters is only about $8,000. That means a homeowner’s net worth is nearly 40 times that of a renter.

When you’re ready to purchase the home of your dreams, it is Steve Schappert who will pull you through. And remember, the U.S. homeownership rate is growing. Grow with it!

This your time to keep on top our nation’s Housing Market. Steve Schappert will be here with you all the way.

Call and Text Steve Schappert 203-994-3950

Email [email protected]

Bring Your Lender!

Truth

You are a concerned homebuyer or homeseller and you need to know what is happening in your housing market so you can make the most informed decisions possible.